Office 3, Level 1, 15 Portico Pde,

(Entry from Cornelia Road)

TOONGABBIE, NSW 2146

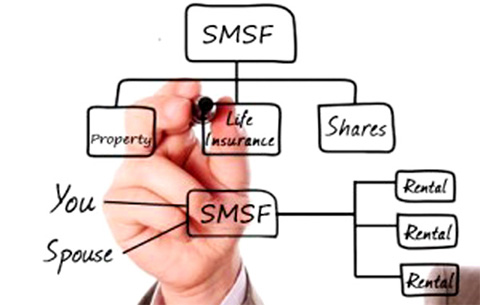

All SMSF trustees are required to have financial statements prepared and lodge income tax return with Australian Taxation Office. The trustee must ensure the SMSF is audited each year by an approved auditor. The audit covers both financial statements and compliance audit.

Reliance Accounting can provide you with all of the above services which includes the compilation of a full set of financial statements, preparing the income tax & regulatory return, other relevant statements and audit of SMSF through an approved external auditor.

Using our services, you can be assured the highest level of quality service. The team at Reliance Accounting are qualified accountants with knowledge, expertise and experience in Self-Managed Superfunds and manage over 50 funds each year.

Reliance Accounting has in place internal procedures to ensure quality service is delivered to the clients at all time.

Prepare of annual financial statements, including operating statement, statement of financial position, notes to financial statements

Prepare and lodge the fund’s income tax return, calculate and advise of tax liability or tax refund due

Audit of the SMSF by an approved external auditor

Prepare member benefits statement, which contains member’s tax components and closing balances

Provide you with detailed investments reports, such as investments movement report, and year-end market valuation report

Facilitate obtaining of an actuarial certificate where required

Manage communications and correspondence with Australian Taxation Office on behalf of the client

Below is the procedure through which you can get your SMSF year end accounts done

Forward us investments and other documents for the fund

We prepare financial statements and tax return

We will send it for audit

Once audited by our approved auditor, sent it to you for signature along with auditor letters

You review and sign; and return to us signed copy

We lodge necessary returns with ATO

If you have any querry for related account ... We are available

Contact us